BBVA is closely following through various lines of research aimed at exploring applications of quantum computing in the world of finance. As part of this work, and in collaboration with Spanish startup Multiverse, the joint research team has evaluated and benchmarked a number of quantum and traditional technologies to improve the process of dynamically optimizing investment portfolios with market data.

Multiverse is a Spanish tech startup that specializes in developing quantum algorithms for the international financial sector.

The results have allowed identifying unexplored methods to carry out these calculations that would allow maximizing the potential returns of investments. The purpose of this collaboration, still in an exploratory phase, has been to determine what weights in an investment portfolio containing certain assets yield higher returns.

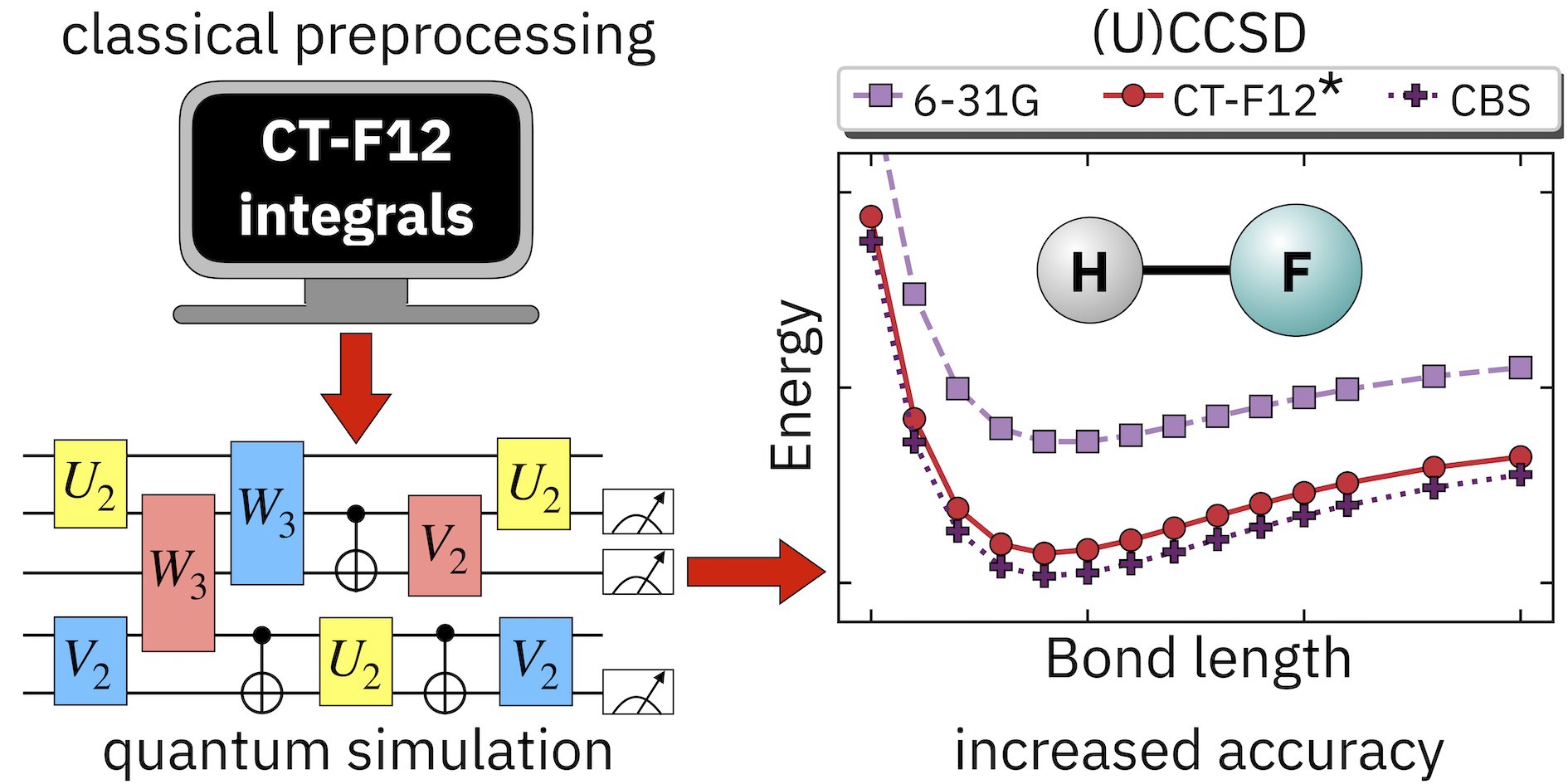

They assessed and compared four quantum computing-based methods and two classical methods used in finance. Regarding quantum technologies, a method based on hybrid computing was run on the D-Wave Hybrid, as well as two other approaches built on the VQE (Variational Quantum Eigensolvers) algorithm, deployed in IBM’s quantum computer Q System One. Finally, an attempt was made to solve the problem using a quantum-inspired algorithm based on Tensor Networks’ platform.

The test carried out between BBVA and Multiverse places the bank at the cutting edge in the deployment of quantum technologies applied to quantitative finance. Since 2018, BBVA has collaborated in a number of quantum computing projects partnering with companies such as Fujitsu, Accenture, U.S. startup Zapata and Spain’s Search Results, Spanish National Research Council. (HPCWire)

The paper can be read there.