Using the D-Wave hybrid solver service, Multiverse Computing developed an algorithmic approach to rapidly generate portfolios that can be optimized against a variety of constraints.

Every investment entails some measure of risk—the fundamental question is whether the reward justifies the gamble. Accordingly, managing a diverse portfolio of financial assets entails a challenging balancing act in order to achieve the maximum reward with the lowest possible risk. This can be a feat of staggering complexity. For example, the number of possible configurations for a portfolio of eight assets in which transactions are performed every month for four years is far greater than the number of atoms in the known universe.

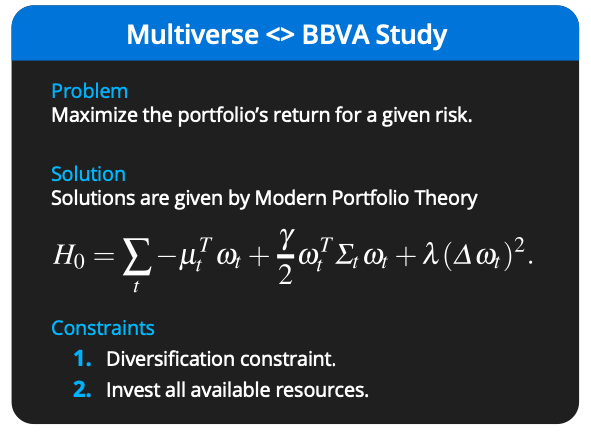

This portfolio optimization problem has proven intractable to classical computing approaches, but Multiverse Computing has now achieved a remarkable breakthrough on this front. Multiverse is a leader in developing quantum computing-based solutions for the financial sector. Using the D-Wave hybrid solver service, which combines the strengths of classical and quantum computing, the company was able to develop an algorithmic approach that rapidly generates portfolios that can be optimized against a variety of constraints.

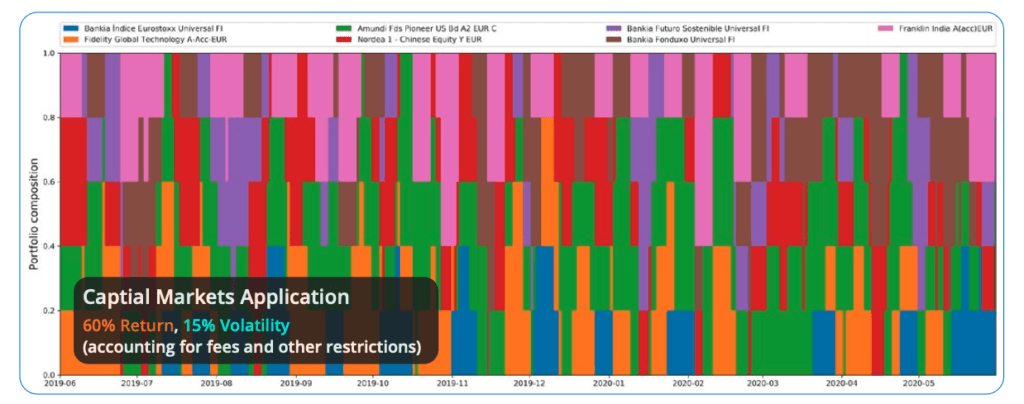

They recently demonstrated the power of this approach in a pair of collaborations with two major European banks, BBVA and Bankia.

The results offered a range of portfolio trajectories that delivered robust gains at every level of risk. For example, the D-Wave analysis identified a portfolio with 15% risk that yielded a 60% return on investment, whereas randomly selected portfolios at the same level of risk were entirely scattered along a continuum ranging from a 20% return to a 20% loss.